Key indices pare early gains, end flat

Continuous foreign fund outflows impacted investor sentiment; However, buying in HDFC Bank, Infosys, NTPC and TCS limited the downfall

image for illustrative purpose

Mumbai Equity benchmark Sensex pared early gains to end lower on Tuesday, pressured by selling in index majors Reliance Industries (RIL), Powergrid and ICICI Bank amid a mixed trend in global equity markets. Besides, continuous foreign fund outflows also dented investor sentiment, traders said. However, strong buying in HDFC Bank, Infosys, NTPC and TCS restricted the decline.

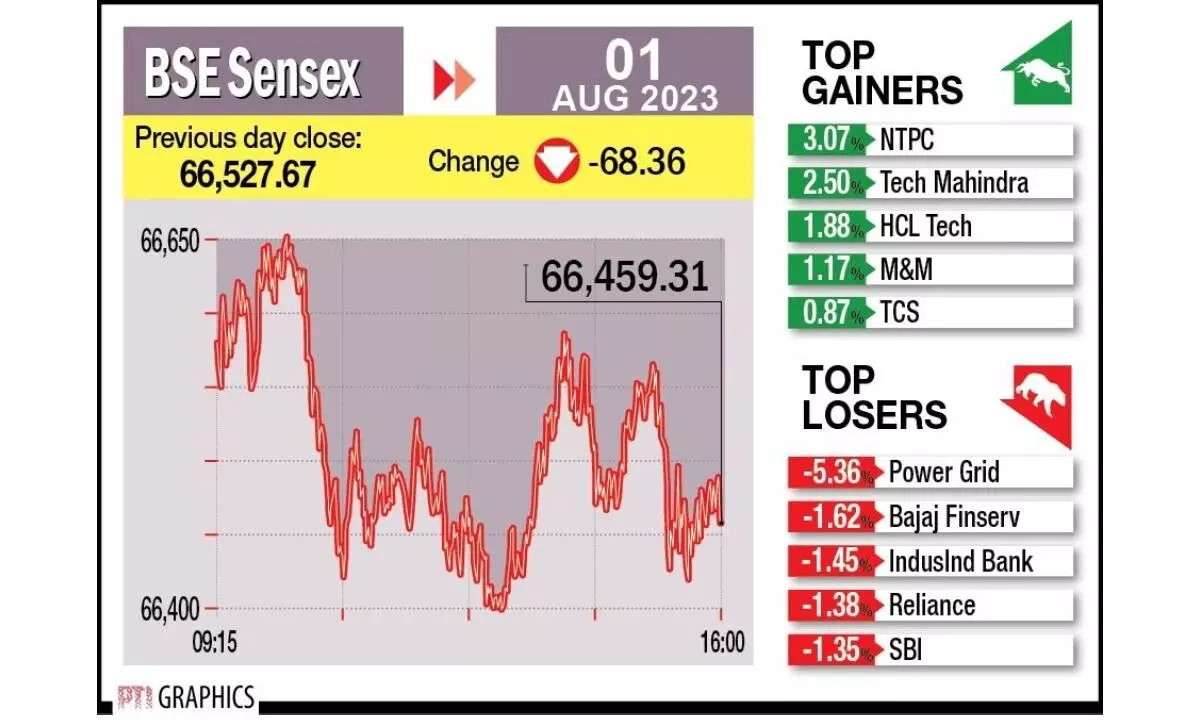

In a highly volatile trade, the 30-share BSE Sensex declined 68.36 points or 0.10 per cent to settle at 66,459.31. During the day, it hit a high of 66,658.12 and a low of 66,388.26. The NSE Nifty fell 20.25 points or 0.10 per cent to end at 19,733.55.

“There was caution amongst the investors as markets exhibited a range-bound trend and ended marginally lower ahead of the RBI’s monetary policy next week. Markets would continue to look for global cues, as the recent rally was too fast-paced, with valuations getting expensive. Markets will continue to select bouts of profit-taking even as the overall undertone remains bullish,” said Shrikant Chouhan, head (research-retail), Kotak Securities Ltd.

“After opening with a positive note, the market showed intraday zig-zag moves within a narrow range for the better part of the session,” said Nagaraj Shetti, Technical Research Analyst, HDFC Securities. “European markets were lower on Tuesday as investors digested a busy week of earnings and weak Eurozone manufacturing activity in July,” adds Deepak Jasani, Head of Retail Research, HDFC Securities.

“The domestic indices traded with a negative bias below the flattish trend, impacted by global peers. IT stocks rallied on hopes of a soft landing for the US economy. India’s manufacturing activity remained robust, although marginally it moderated for the second consecutive month in July. The market direction in the upcoming days will be influenced by key data points, including auto sales figures, US PMI, and US job data,” said Vinod Nair, head (research) at Geojit Financial Services.

Overall, we expect the market to consolidate in a range with a positive bias as we move further into the earning season.